Thursday, July 17, 2008

The Neo Dimension

See you!

Wednesday, July 16, 2008

I am this month featured blogger

I am this month featured blogger of BLOG2u. DK, thanks for recommending! Also, I would like to thank the founder of Blog2u - Paddy!

I am this month featured blogger of BLOG2u. DK, thanks for recommending! Also, I would like to thank the founder of Blog2u - Paddy!Here is the link http://www.blog2u.sg/blog/index.php/2008/07/16/featured-blogger-neo-wee-wu/

Family, Friendship, Love and Oil

“Eureka’ Film

It is a film about a Shell (stock quote NYSE:RDS.A)Engineer, Jaap Van Ballegooijen was given a task to improve the drilling system such that it can prolong the oil field at a economical level. As the story goes, Jaap has to strike a balance between his work and personal life (especially his son)……The film also gave a quick overview of the snake well drill created by Jaap in the show.

“Clearing the Air”

I kind of like this film as it encompasses many hidden emotions of the lead actor (name: Theo Bos) such as passion, love and friendship. So what is this film trying to tell? This film shows the adoption of GTL (Gas-to-Liquid) of natural gas. It is supposed to be cleaner and I supposed everyone knows that such fuel have actually been implemented. Taxi in Athens used SHELL(stock quote NYSE:RDS.A) GTL.

I think such initiative should be encouraged as pollution is really bad these days. However, I am really not sure how snake well drill can actually prolong the oil field. Any engineers can explain that, please drop me a comment. Thanks!

p.s. The real energy website is http://realenergy.shell.com/?lang=en_CN&page=homeFlash

Sunday, July 13, 2008

Tuesday, June 24, 2008

Saturday, June 21, 2008

Entreprenuership in Singapore. Why not?!

MK shared with me his plan of setting up a concept café at some private estate region in a central part of Singapore. His target market segment is the more affluent individuals who have the time and money to spend on more luxurious services and products.

All the items displayed in his café will be very unique arts pieces ranging from artistic portrait to uniquely-designed utensils which will be constantly updated to maintain the “freshness” of the café. If the customers like any of the items, they can buy it directly from the café.

I feel that his idea is very creative yet very viable as long as it is the correct location and the window dressing of the café place is beautifully done. I ask, “Why not? Go ahead and start your business.” For those who have heard many of such business conversations, I am sure you will know what kind of replies my old pal gave during the conversation. “No capital”, “no time” etc.

I am sure MK is just one of my many friends who want to start his own business. Many said that Singaporeans lack creativity and entrepreneurial spirit but I tend to see otherwise. Singaporeans lack the courage and determination to leave their comfort zone and pursue their dreams. I think we really need to do something to create awareness for Singapore’s entrepreneurship scene.

A couple of days ago, I received an email from Blog2u regarding on this campaign called “Why not?” organized by ACE (Action Community for Entrepreneurship). It is a contest that serves to promote entrepreneurship and innovation in Singapore. Participants in this contest can submit new ideas on how to (i) increase Singapore’s attractiveness as a place for business, (ii) nurture entrepreneurs of tomorrow or (iii) encourage innovative and competitive businesses. Contestant will simply explain their “Why not” ideas in less than 100 words and submit their entries online at this site: http://www.ace.sg/acewhynot/webpages/whynotform.aspx by 17July 2008. There will be more than $2000/- worth of prizes to be won in this contest. Visit the official site of ACE at http://www.ace.sg/

.jpg)

This advertisement is brought to you by BLOG2u (http://blog2u.sg).

Personally, I feel that Singapore government agencies are making good effort in building an entrepreneurial ecosystem in Singapore. I believe that we should be supportive of such initiatives.

Monday, June 2, 2008

China Banking System

I wrote a report on the Chinese Banking system. Since i am currently in China, I have translated to Chinese. Hopefully, you guys understand what i am writing. The abstract is as followed.

"从计划经济到市场经济,中国经过一系列的改革。在这篇论文,我将讨论中国的银行体系。在中国银行体系改革之前,中国已积累了大量的不履约贷款(不良资产)。虽然中国政府已实施了几项措施,以减少不良资产,但这样的问题依然存在。截至于2007年年底,不良贷款总额为12700.0亿人民币,其中估计约6 %(不良贷款率)的贷款总额在银行体系。若以5 %的国际准则为标准, 6 %的不良债款相对而论是属“不健康水平”。

大量的不履约贷款的问题基本上归公于两大因素:(1)中国人民银行(People’s Bank of China, PBC)—中国的中央银行, 缺乏有效货币规划(2)国家经营的银行(State-Owned Banks, SOB)缺乏有效的贷款管理。"

I have shared my full report in google document. For Chinese report, click here. For english report, click here.

Tuesday, May 20, 2008

She is not hot! but the song is nice!

She is Ayaka Lida

Monday, May 5, 2008

JOB! JOB! JOB!

I am certainly looking forward for that moment! It marks the end of my studies life (i think i am already very old to study again! haha! unless there is somebody willing to sponsor me to go for a MBA. hehe!) and the beginning of the next stage of my life - WORK!! Haiz...this has been another worry that i have in mind. Despite the fact that i have offers, i am still sourcing for better alternatives that can fulfill my objectives. I won't want to take up a job that i don't see any growth potential or simply i don't have interest in. In another words, i am still "jobless"!!

Hey guys! if you have any job opportunities that you wanna share with me, please feel free to drop me a note here! I am actually looking for investment firms that are specializing in equity funding. you can view my CV here.

p.s. I am really glad to know Ridz, Tian Hong and Kelvin. Their involvement in my life have certainly helped me one way or another in mapping my career path. There are simply too many industries that i had interest with. However, i see my strength in business analysis. Thus, i would like to focus on my core competency in this area. Guys, thank you so much!

Thursday, April 10, 2008

what is Animated Director?

Sunday, April 6, 2008

Dolphin massacre in Japan

I have just read and signed the online petition:

"Stop the dolphin and whale killings in Taiji"

hosted on the web by PetitionOnline.com, the free online petition

service, at:

http://www.PetitionOnline.com/golfinho/

Video

I personally agree with what this petition says, and I think you might agree, too. If you can spare a moment, please take a look, and consider signing yourself.

Thursday, March 27, 2008

Chinese Manufacturers' Worries on Inflation

Since the opening up to the outside world in 1978, China has been very successful in positioning itself as the “world factory” exporting Chinese-made products to all parts of the world. In 2004, China overtook Japan to be the third largest exporter just behind Germany and United States (U.S.). At the pace it is growing, it is not impossible for China to overtake Germany and U.S. to be the largest exporter in the near future. However, overheated China is currently facing inflation problems. The Chinese manufacturing is the key sector affected by the inflation.

China economy is highly dependant on its export. In 2007, China’s export contributed 36% of its gross domestic product (GDP). Most of the Chinese-made products are exported to the developed economies.

Attributing to its success of export model, China economy is overheated. Inflation has been the core problem of the china economy. The phenomenon is clearly observable in the beginning of the year 2008. Besides the massive economic damages, the recent snow storm has caused a surge of food price in Feb 2008. Accompanied by the rising oil price, the inflation rate has gone as high as 8.7% in Feb 2008. Clearly, the high inflation increases the cost of raw materials affecting the business operation of the Chinese manufacturers.

In short, the short term outlook of China’s manufacturing sector has become uncertain. In this paper, we would want to explore the possible impact of inflation on the Chinese manufacturers.

2. Manufacturing Sector: Labor-intensive Products and Trade-induced Investment

Prior the economic reform in 1978, China has been facing a series of political and economic instabilities. Economic progress was slow and trade occurred mostly with the Soviet Union, a communist-ruled country.

As one of the world’s most populous country, China has the comparative advantage of supplying cheap labor to the global economy. Ever since the opening up, China has attracted many foreign companies to set up manufacturing plants producing labor-intensive products such as textile and steel. The investments usually come from overseas. In the year 2003, the total foreign direct investment (FDI) has hit US$53B in which Hong Kong, U.S. and Taiwan made up the majority of the investment.

In 2003 and 2004, manufacturing accounts about 70% of FDI inflows. (Barry, 2007) Yangtze River and Pearl River Delta, the core of the Chinese manufacturing sector, are the key investment hotspots. The development of the manufacturing sector has helped to curb unemployment especially in the Yangtze River and Pearl River Delta areas. Based on the official data in 2002, the manufacturing sector comprised about 15% of the whole labor force.

3. China’s Production Model

China’s trade has increased tremendously ever since the opening to the world economy. China’s trade surplus has soared to US$262B in the year 2007. This trade pattern is most prominent as exports starts to outpace imports after China’s entry to World Trade Organization in the year 2001.

China’s only comparative advantage over the rest of the world is the abundant of cheap labor. However, it lacks the skill and capital of developing technology-intensive products. Over-reliance on labor-intensive products is not going to be sustainable and hence, China has to resolve in “importing technology and skills” from developed economies such as U.S and Japan in order to stay ahead in the competitive global market. Results of this “Large In, Large Out” (大进, 大出) have been rewarding as exhibited by a high surge of both exports and imports in the recent years.

Red – Imports, Blue - Exports

Source: International Financial Statistic, 2008

China’s production model has started to diversify to technology-intensive products which involved more complex manufacturing processes. In the recent years, many foreign technology firms started to outsource some production to China producing semi-finished or final products. This trend is more observable in the electronic sectors. Well-know foreign brands such as General Electric(stock quote: GE), Apple(stock quote: AAPL) and Philips (stock quote: PHG)have their products (or components of their products) assembled (or manufactured) in China. In the year 2007, China accounts as high as 15% of the total trade in the world’s electronic sectors.

Based on the figures in the year 2002, semi-finished products comprised as high as 63.3 per cent of the total imports. These (semi-finished) products were processed in China and exported (as a final product) to the rest of the world (final product accounts 60% of the total export). The same production model applies for China’s export of semi-finished products. This is called trade processing.

Trade processing is a global trend. Intuitively, this global trade pattern strikes a “more-balanced” term of trades between China and developed economies as trade flow is not longer a single direction from China to developed economies.

4. China’s Present Inflation

Rising Oil Price

“Large In, Large Out” model has made China an important part of the world’s supply chain. However, it has also made China economy vulnerable to external factors. The more prominent factor which is affecting the whole world is the soaring oil price.

Oil is the raw material of all productions. As the “factory of the world”, China has to depend on imported oil for energy and production. The purchase of relatively expensive oil abroad has certainly “imported” inflation to its economy. In February 2008, the crude oil prices in China soared 37.5 per cent, up from 29.9 per cent the previous month, while coal prices were up 19.4 per cent year-on-year (YoY), up from 14.9 per cent in January.

Snow Storm

The snow storm during January and February 2008 was the worst snow storm that China encountered for the past 50 years. Transportation and power supply have been disrupted causing an economic loss of US$15B. More importantly, the shortage of agriculture output caused by the snow storm has surged the price of food in the country. The rising food price has been the main contributor of the recent inflation hike of China.

Currency Devaluation

China has been undergoing a cycle of hyperinflation (pre-1998) and deflation (post-1998); this is mainly due to the poor implementation of monetary policies in the earlier stage of economic reform resulting the devaluation of Reminbi. (RMB) Although deflation has put to a stop in the recent years, side effects of the poor monetary management (inflation) still present at the present era.

5. Chinese Manufacturers Face Inflation and Rising Wages

Chinese manufacturers are the main driver of the economy. Despite the high economic growth that China enjoyed, processing trade still dominated by the foreign trade. In 2006, exports comprised only 53 per cent of total trade i.e. the surplus between export and import was very small.

Soaring oil price has certainly rises the cost of raw material, transportation and energy. The inflated cost is going to further squeeze Chinese manufacturers’ profit which is already very small. The rising cost issue is further worsened when workers demand for higher wages to meet the needs of rising food price. In Guangdong, Chinese manufacturers were forced to raise wages by 18% in order to resolve the labor riot. (Marketwatch, 2008)

Certainly, inflation has affected the profitability of the Chinese manufacturers. In a logical sense, Chinese manufacturers will have to push some cost to the consumers in order to stay profitable. As China is “tightly tied” to the world’s supply chain, a price rise of Chinese export will certainly spark the next wave of global inflation.

However, manufacturing sector is highly competitive. Products such as electronic components or assembled products, for instance, are highly substitutable. Hence, raising the price may not be the viable option for manufacturers to compete in the market. There are signs that China’s manufacturing growth is slowing. CLSA Asia Pacific Markets reported that China’s seasonally-adjusted Purchasing Manager Index (PMI) has fallen to 52.8 from 53.2 in January and February 2008. A reading above 50 indicates growth. (CLSA, 2008)

Manufacturers are challenged from both supply- and demand-side factors – inflation and price competition. Less efficient manufacturers will be driven out of the game whereas more efficient one may resolve in labor retrenchment to cut cost. Both will only lead to one outcome – unemployment.

6. Contractionary Policy

Clearly, China, which relies on imports for production inputs, has to strengthen RMB currency to lower the cost of imports. During the press conference of the 11th Nation People’s Party Congress held on 18th March 2008, Chinese Premier Wen Jiao Bao has declared that inflation is at the top of the agenda in formulating economic policies. (Chinadaily, 2008)

The People’s Bank of China (PBC), the Central Bank of China, has increased the required bank reserve ratio (RRR) to as high as 15.5%, starting from 25 March 2008 to cool the economy. This is the twelve time ever since 2007 that PBC increases the RRR. Besides the increase of RRR, PBC has sold 130B RMB worth of government bills through open-market operation to soak up excess liquidity in the market.

The contractionary policies have been effective. Chinese RMB has appreciated to 7.025 RMB against U.S. dollar, a 3.7 per cent gained in the beginning of the year 2008 and it is not unlikely that 1 U.S dollar will be traded less than 7RMB in the later part of 2008.

7. Conclusion

Inflation has increased the cost of production to the manufacturers squeezing their profit margin. If inflation continues to rise, manufactures may layoff workers creating unemployment in the economy i.e. stagflation may occur. Despite the market’s sentiment that China’s export will be affected due to the weaker demand in the U.S. economy, PBC has prioritized their stand to curb country’s inflation through its aggressive monetary policies.

Indeed, PBC’s objective of appreciating RMB does help to lower the cost of imports to a certain extent. With U.S. Fed continue to pursue expansionary policies, U.S. dollar (the international currency) continues to devalue. The combined efforts of both China’s PBC and U.S. Fed will only make Chinese products even more expensive. This will still lead to global inflation. China, which now has economic power to influence the world price, should take this into account when formulating their economic policies.

Sunday, February 24, 2008

Dessert Trip@ Shanghai

We walked into this 塘皇甜品at 万达广场to have some desserts. Everything is pretty cool until the waitress processed a wrong order but the matter has been resolved quickly until I demanded my 汤圆核桃糊

The dumplings are delicious but the 核桃糊is too sweet and dry perhaps it is because the local like to eat very sweet dessert. I paid 16RMB (about S$3) for汤圆核桃糊.

I have uploaded more shanghai photos. You can access more china photos of mine here.

Meet up with Wei Yi

I ordered a plate of sphatti with minced beef and the price is quite steep. It costs me 48RMB for that plate of sphatti and I have enjoyed the meal given the good ambiance of the place.

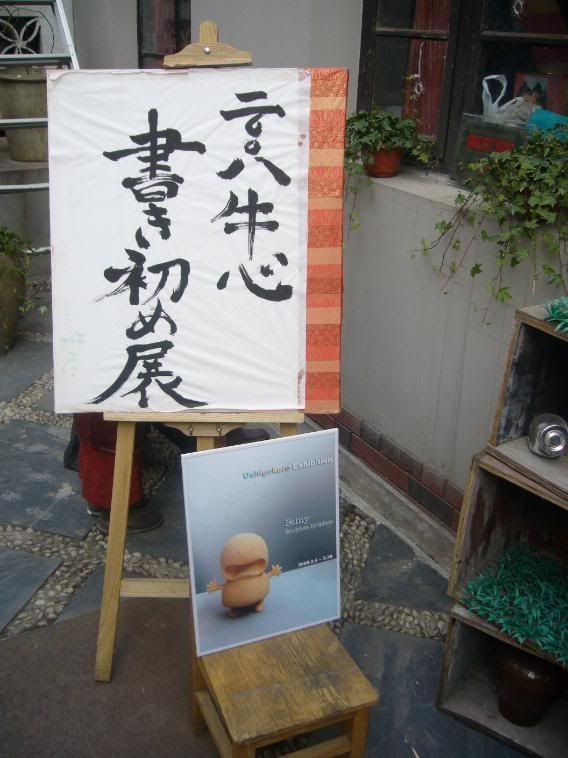

Besides the restaurant, a well-decorated garden with a Japanese board caught our attention. It is a small gift shop but i believe it is run by Japanese. The shop is filled with small little boxes. It shared the concept of Pandora Box in

Wei Yi, like other women, was happily looking for her apparels and accessories in the store.

You can access my other China photos at this link.

Friday, February 8, 2008

My Nanjing Trip

Picture of 灵谷塔

Video I took on the top of the 灵谷塔

Picture of 孙中上’s tomb at 中山陵

Wednesday, February 6, 2008

CNY Fireworks for 4 hours!

Wednesday, January 30, 2008

A beyond - expectation movie but good Singapore food in Shanghai!

I supposed to meet Wei Yi, my schoolmate who is also serving in the same attachment company as mine at the metro station for the movie. However, I was late and I actually fell when I was rushing down from the staircase; probably due to the snowy floor and the poor friction of my shoes.

As for the movie, I don’t think it is a comedy movie. The movie is narrating the relationship between a poor family and ET more like a warm and heartening show. If you are expecting a lot of ridicules and funny actions as in Shaolin Soccer and Kunghu Hustle, you might be disappointed.

The story revolves around a child who had a special encounter with an ET. Stephen chow is more like a very big EXTRA in the show but I think this is what he is going to do in his subsequent movie in the future. Overall, this movie does not meet my expectation but it has surprised me in another way. It is still worth the money to watch this show as you can observe that Stephen Chow is changing his style of filming.

Here’s the trailer. You may find some familiar scene of Shaolin Soccer and Kunghu Hustle

After work, I went dinner at 鼎泰丰 at 新天地. As I was alone, I only order a plate of fried rice with prawn (虾仁蛋饭) and 2 sesame buns(芝麻大包). I went to 鼎泰丰 before in Singapore and I didn’t have high expectation of the food. Ironically, 鼎泰丰 in新天地 seem to taste nicer than in Singapore. Also, the service is much better. Unlike other restaurants in Shanghai, the waitresses are more polite and more attentive on what the customers want.

虾仁蛋饭

芝麻大包

Price wise? You won’t see a big difference as compared to Singapore probably because it is located at新天地广场 which is a premier place in Shanghai. 虾仁蛋饭 costs about 42 RMB and芝麻大包 (2 X) cost about 20RMB.

Saturday, January 19, 2008

Transformer 2 storyline leaked

Tuesday, January 15, 2008

Latest sexy, slim and light Mac

The spec is at Apple's website.

I have also inserted the youtube video.